Rose Wines World Tracking

Publication Key Figures 2023

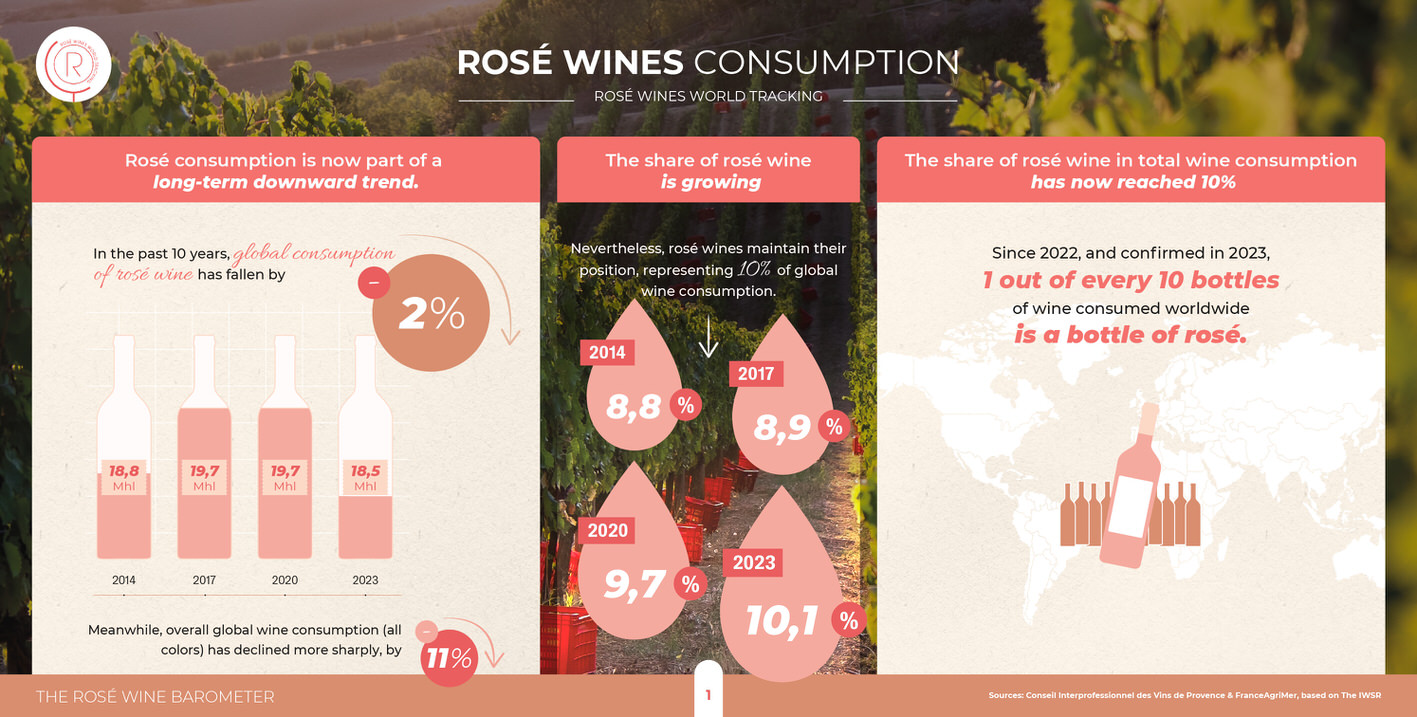

Global consumption of rosé wines continued its downward trend in 2023, mirroring the slowdown in international trade flows, while production increased.

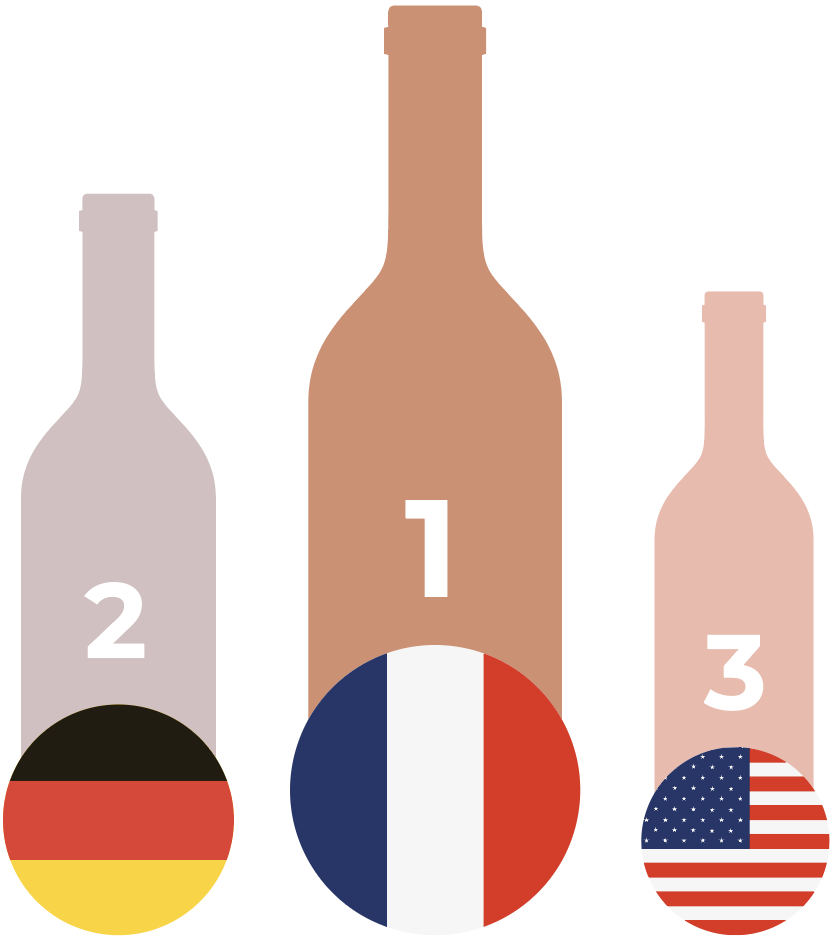

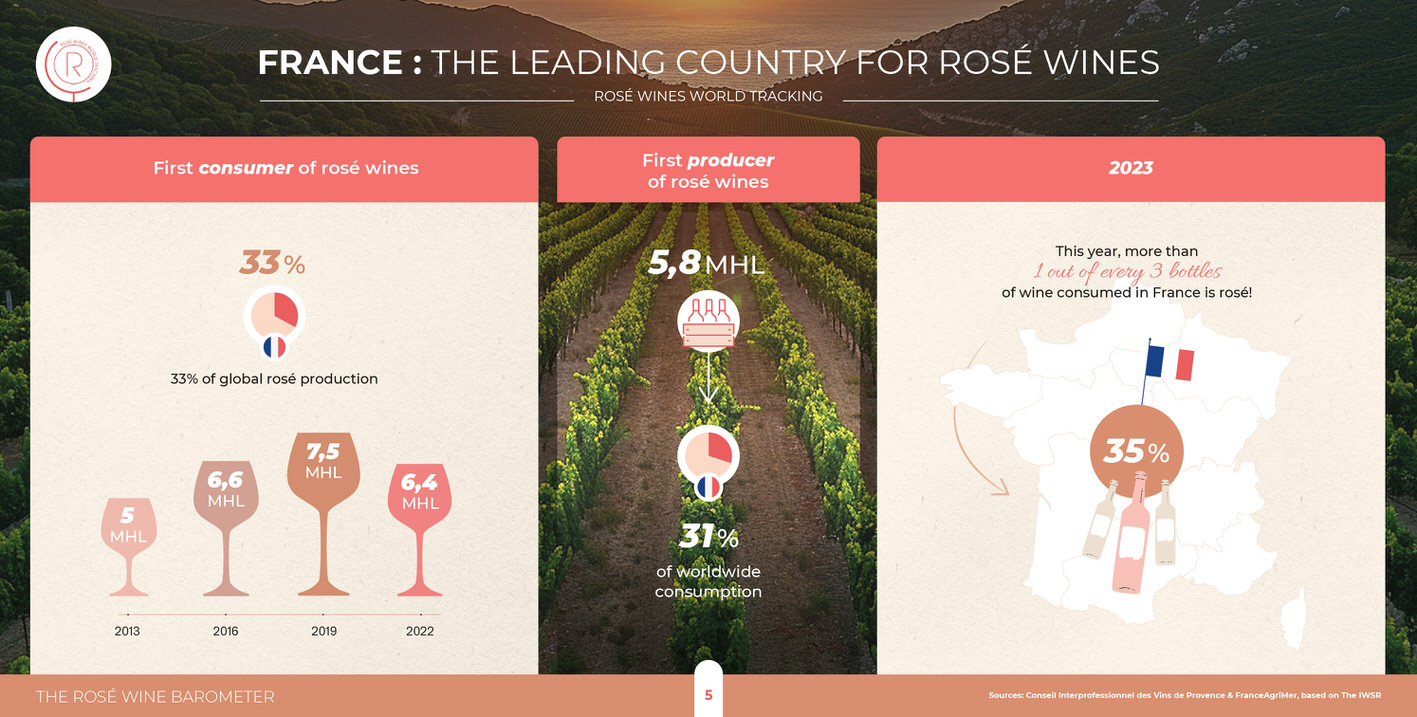

The year 2023 confirmed that, after peaking in 2019, global rosé wine consumption has entered a downward trend. This decline is nevertheless more moderate than for still wines overall (-1.7% per year on average for rosés between 2019 and 2023 vs. -3.8% for the category). Consumption remains concentrated in France, Germany, and the United States, although these countries are losing market share to more diffuse growth centers, notably in Central and Eastern Europe and in Oceania. However, in 2023, some major markets such as Italy, Canada, and Spain returned to growth.

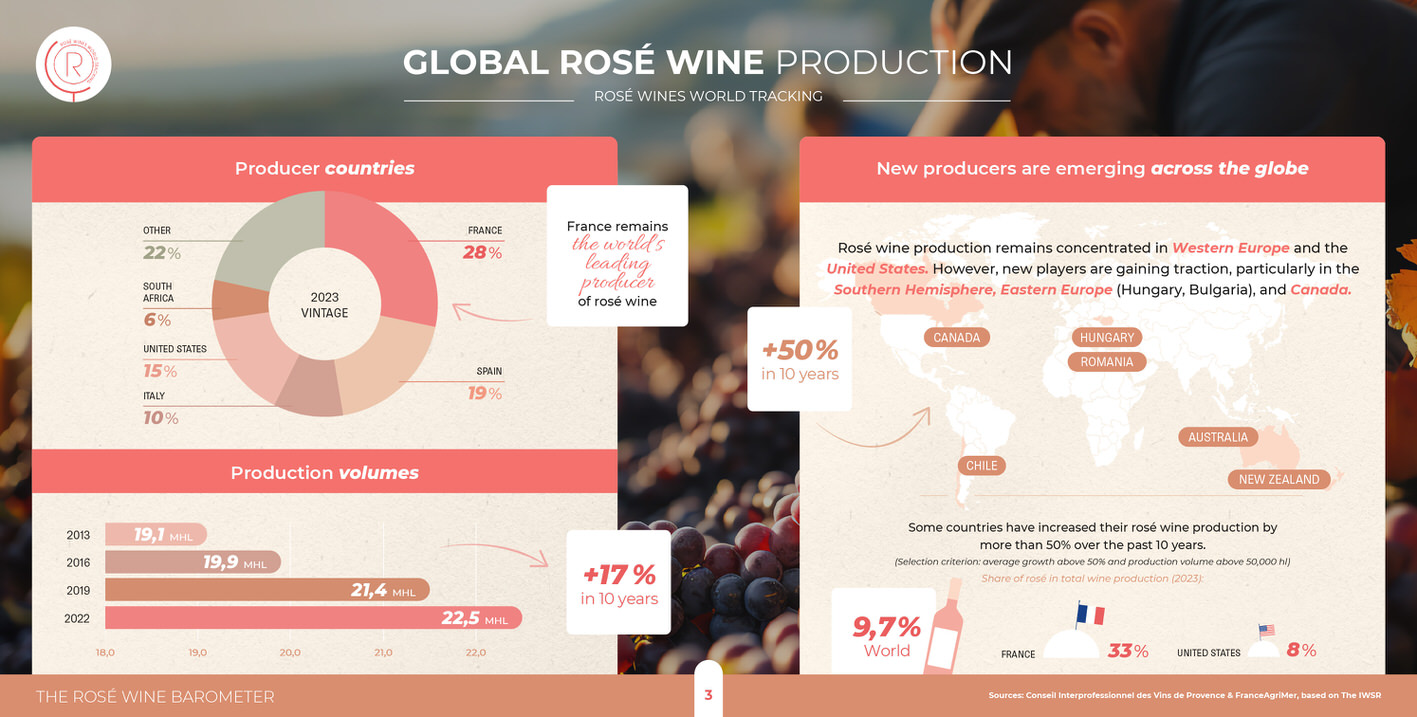

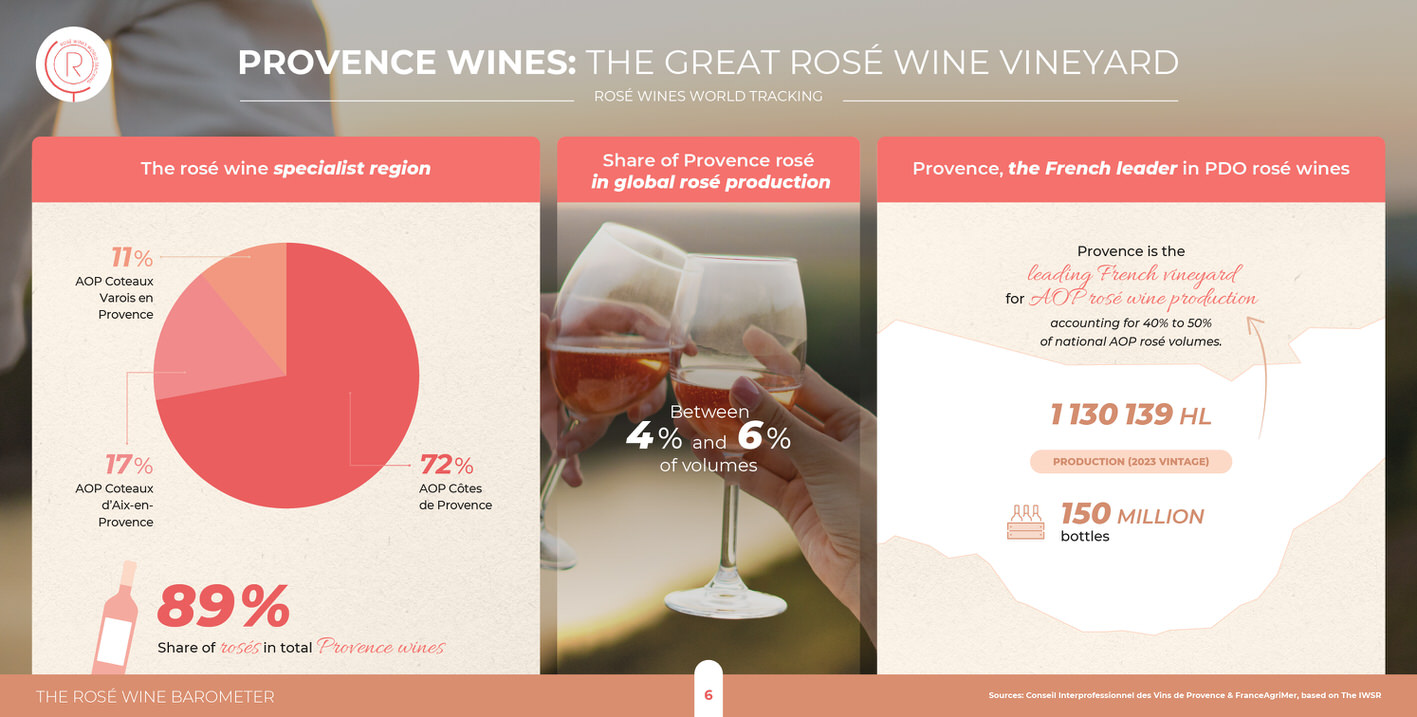

Global rosé wine production rebounded in 2022 to reach 22.5 million hectoliters, returning to levels similar to 2018 and 2020. Long-term balances have changed little, with France, Spain, Italy, and the United States accounting for 73% of global production, though regions such as the Southern Hemisphere, Eastern Europe, and Canada are showing growth from smaller bases.

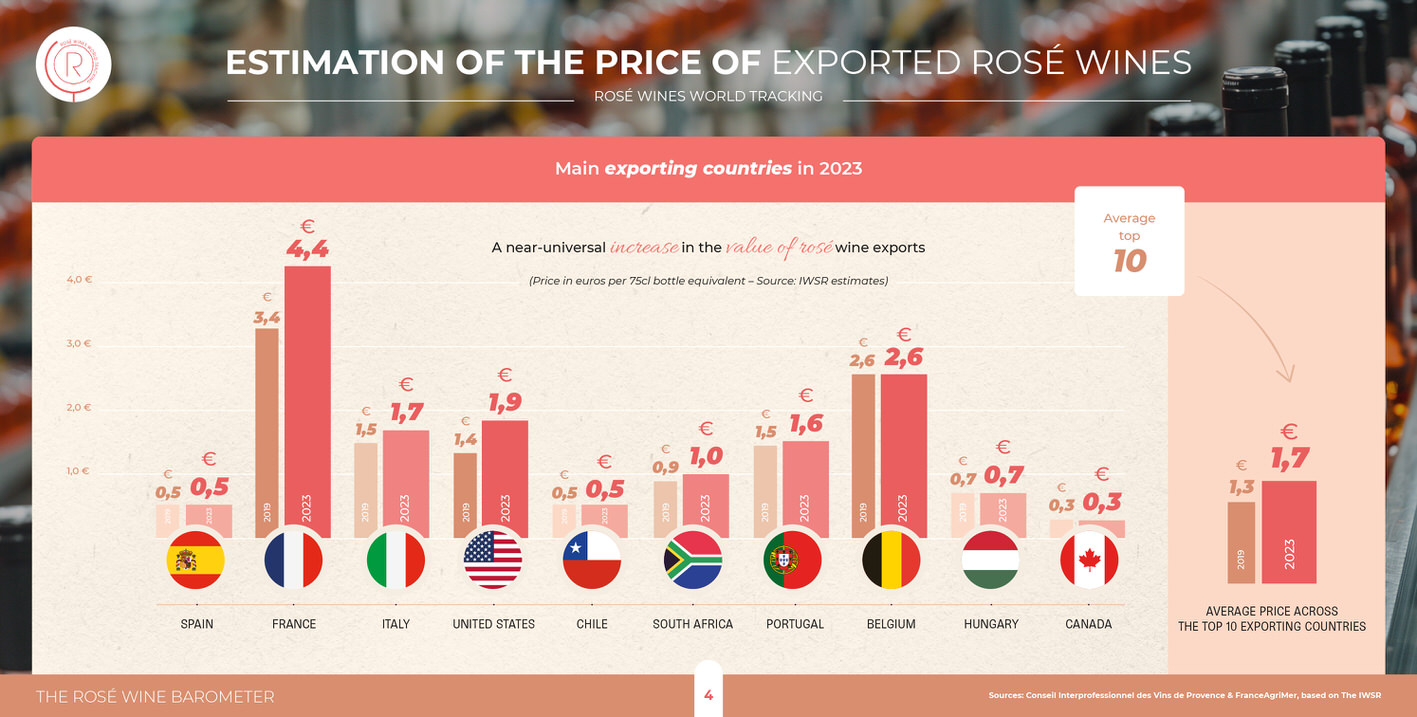

The slowdown in rosé wine imports and exports was confirmed in 2023, marking a decline com- pared with the 2021 peak. Despite this absolute slowdown in international flows, rosé wines conti- nue to gain market share within global still wine trade. The premiumization of rosés has slowed after two years of strong increases, although the average price of French exports continues to rise.

Despite the structural decline in its domestic consumption, France remains an undisputed leader: the number one producer, number one consumer, number one exporter by value (second by volume), and number one importer by volume (mainly entry-level Spanish rosés). It is also worth noting that in 2023, the United States appears to have shifted from a net exporter to a net importer of rosé wines, as falling exports and declining domestic production were no longer sufficient to meet internal demand.

Source : The IWSR

45 countries

studied

45 countries

studied

Approximately 20 experts consulted to gain insight into the

latest market trends

Approximately 20 experts consulted to gain insight into the

latest market trends

Use of

numerous consumer panels

Use of

numerous consumer panels

Tracking

since 2002, throwing up long-term trends

Tracking

since 2002, throwing up long-term trends

A unique tool

recognized by industry members

A unique tool

recognized by industry members